- Wealth Builders Weekly

- Posts

- Week 2: How do I create a monthly budget that works?

Week 2: How do I create a monthly budget that works?

Week 2: How do I create a monthly budget that works?

Looking into this topic, I’m appalled by what’s usually recommended.

Categorizing and prioritizing dozens of categories of expenses overwhelms many.

It’s why budgets end up like most diet and exercise plans a few months into the year.

I prefer 2 streamlined methods for most people but the categorized method is also supported in my financial planning software.

The key is a system you can stick to. Let’s get started.

Account For Your Income

The first step in creating a budget is knowing exactly how much money you have coming in each month. This includes:

Net income after taxes and withholding from your job is where it starts for most people.

Side hustle, bonus, commission, or other inconsistent earnings should be accounted for too.

Determine Your Expenses

Before setting limits, you need to know where your money is going. For one month:

Record every expense, from rent to your daily coffee.

Using a credit card for one month can make this easier to account for.

Categorize them.

Pay No Interest Until Nearly 2027 AND Earn 5% Cash Back

Some credit cards can help you get out of debt faster with a 0% intro APR on balance transfers. Transfer your balance, pay it down interest-free, and save money. FinanceBuzz reviewed top cards and found the best options—one even offers 0% APR into 2027 + 5% cash back!

Choose Your Preferred Method. Here’s 3:

The simpler the method the better in my opinion. Here are 3 I support and facilitate in my planning relationships as an example.

50/30/20:

One Number

Traditional

50/30/20

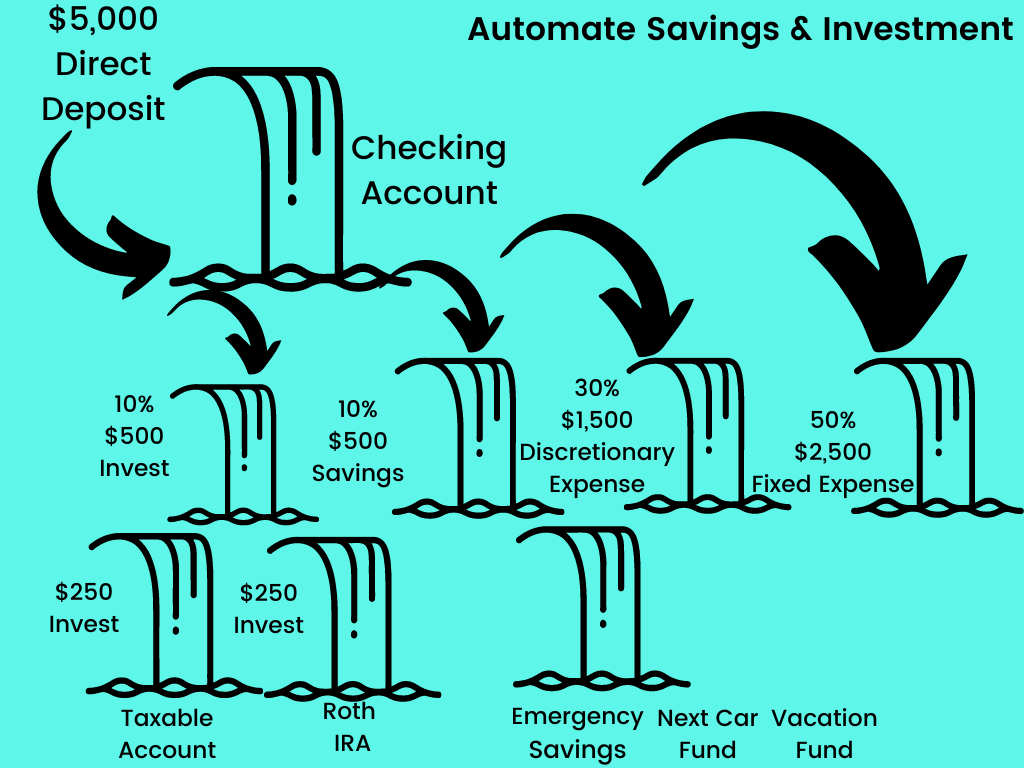

Now that you know your expenses, allocate a portion of your income to each category. A popular framework is the 50/30/20 Rule:

50% of income for needs.

30% for wants.

20% for savings/debt repayment and investment.

Below are examples of each method in order.

50/30/10/10

Blah, just shoot me instead of suffering through this sheet!

Adjust as Needed

Review it monthly for maybe 10-15 minutes and adjust if:

Expenses increase (e.g., inflation or new bills).

Income changes.

Financial goals shift.

Use tools or habits to stick to your budget. Right Capital is the vendor I use and their budget software tracks your expenses against your budget method plus a variety of other great functions.

A monthly check-in lets you know how you did without being a burden.

Partnering with an accountability buddy or financial planner helps too.

Final Thoughts: Make Your Budget Work for You

The best budget is the one you can stick to. Start small, celebrate wins (like paying off a debt or hitting a savings milestone), and don’t be afraid to tweak your approach.

I provide comprehensive fee-only financial planning and investment management for clients in the St. Louis area and nationwide virtually. Many are busy professionals and multi-generational families. Learn more here.

If you’re not a subscriber already, hit that button below to receive new tactics each week to help you grow income, reduce expenses, and save more now!

Reply